Rich Get Richer and the Poor Get Poorer

Rich Get Richer and the Poor Get

Poorer

No

doubt, the wealthy (Romney leading the gaiety) are dancing in the

streets, not celebrating their gain but dancing for joy over the

Hoi polloi's (93% of us) losses. thinkingblue

A Rise in Wealth for the Wealthy; Declines for the Lower 93%

An Uneven Recovery, 2009-2011

by Richard Fry and Paul Taylor

Overview

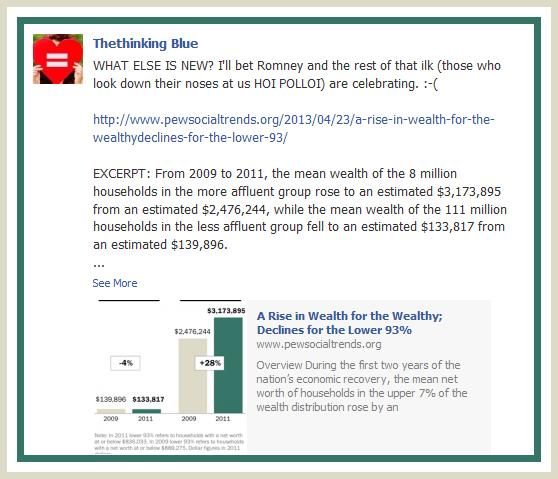

During the first two years of the nation’s economic recovery, the mean net worth of households in the upper 7% of the wealth distribution rose by an estimated 28%, while the mean net worth of households in the lower 93% dropped by 4%, according to a Pew Research Center analysis of newly released Census Bureau data.

From 2009 to 2011, the mean wealth of the 8 million households in the more affluent group rose to an estimated $3,173,895 from an estimated $2,476,244, while the mean wealth of the 111 million households in the less affluent group fell to an estimated $133,817 from an estimated $139,896.

These wide variances were driven by the fact that the stock and bond market rallied during the 2009 to 2011 period while the housing market remained flat.

Affluent households typically have their assets concentrated in stocks and other financial holdings, while less affluent households typically have their wealth more heavily concentrated in the value of their home.

From the end of the recession in 2009 through 2011 (the last year for which Census Bureau wealth data are available), the 8 million households in the U.S. with a net worth above $836,033 saw their aggregate wealth rise by an estimated $5.6 trillion, while the 111 million households with a net worth at or below that level saw their aggregate wealth decline by an estimated $0.6 trillion.1

Because of these differences, wealth inequality increased during the first two years of the recovery. The upper 7% of households saw their aggregate share of the nation’s overall household wealth pie rise to 63% in 2011, up from 56% in 2009. On an individual household basis, the mean wealth of households in this more affluent group was almost 24 times that of those in the less affluent group in 2011. At the start of the recovery in 2009, that ratio had been less than 18-to-1.

---

How Wall Street Undermines Democracy!!!

Published on Feb 14, 2013

The free market doesn't work and Noam Chomsky explains how Wall Street DESTROYS democracy. Remember the term "neoliberal" in the phrase "neoliberal package" is meant to describe Trickle-Down economics that benefits the wealthy at the expense of the poor & middle class (The 99%).

Noam Chomsky says:

"It's rather striking to see how every element of the neoliberal (http://en.wikipedia.org/wiki/Neoliber...) package is specifically designed to undercut democracy. It's rarely discussed and people talk about it's economic effects, but just thin it through. Let's take, say, financial liberalization (http://en.wikipedia.org/wiki/Economic...).

The core, for Keynes, the Greatest Achievement of the Bretton Woods system (http://en.wikipedia.org/wiki/Bretton_...) was to institute financial regulation, and there's a reason. That provides space for governments to undertake programs that are supported by the population. (http://en.wikipedia.org/wiki/Post%E2%...)

If you have no constraints on capital flow and you can attack currencies frequently, freely, that creates what international economists sometimes call a 'Virtual Parliament,' with investors and lenders who can, I'm quoting from technical literature, can carry out a moment-by-moment referendum on government policies. And if they think the policies are irrational, they can vote against them by capital flight, by attacks on the currencies, and so on.

The policies that are irrational are, by definition, those that benefit people, but don't improve profit and market access and so on.

And, therefore, governments face what's called a 'dual constituency:'

their own population and the 'virtual parliament,' and the virtual parliament usually wins, especially in poor countries.

For the rich countries it was modulated into... First of all, they didn't accept the neoliberal package as completely as say, Latin America, but to the extent that they did, the effects are predictable. And the same is true of other neoliberal programs.

Take, say privatization, which became a mantra. Well, by definition, privatization undercuts democracy:

take something out of the public arena and puts it into the hands of unaccountable private tyrannies that are created and supported by the state, which is what corporations are."

<< Home